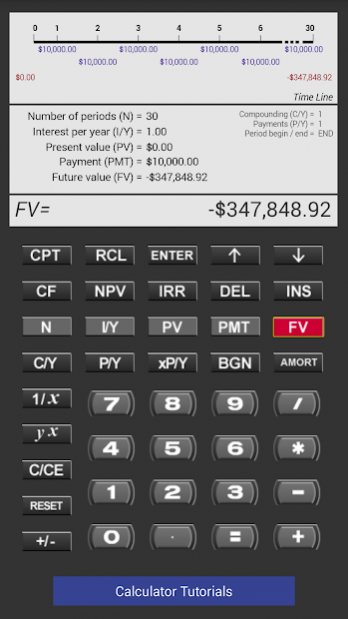

The tool calculates the total amount of interest you'd pay over the life of the loan if you made either your minimum or maximum monthly payment. Input a loan's beginning balance, the most and least you'd be able to pay each month and the loan's annual percentage rate. This simple financial calculator shows how interest affects any type of loan. Or, enter the monthly payment amount that's best for your budget and find out how long you'd need to make those payments in order to wipe out your balance. Then, type in the number of months in which you'd like to pay off your card to see the monthly payment necessary for meeting that goal. Start with your current balance and annual percentage rate.

#Financial calculators online free how to

Get an idea of how to tackle your credit card debt with this payoff calculator. There also is an option to factor in any extra payments you may want to make and show how those payments would help pay off the car loan sooner. Bankrate's auto loan calculator estimates your monthly car payment, depending on how much money you'll need and the interest rate you're likely to land. Looking for a new set of wheels? You'll likely have to borrow money to ride around in style.

You're also given an estimate of the annual salary you'll need so you can afford to pay off the loan. Once you're ready to start making good on that debt, student financial aid website has a calculator that estimates your monthly payment over the term of your loan and shows the total amount you'll repay, including interest.

Most lenders give you a six-month grace period after graduation before you're expected to start repaying your student loans. Fine-tuning your expenses shows how your discretionary income changes if you spend more or less. You input your earnings and various costs, such as housing, utilities and child care, then click to see how much money should be left each month for savings and other things. Mapping Your Future offers a very straightforward budget calculator that can help you come up with a monthly spending plan. "The simpler the calculator, the better," says Fox, of Iowa State University. The calculator gives an analysis of how much more you'll need to save each month to reach your emergency fund goal. You enter the amount of money you currently have available and how long you expect your emergency fund to last, then you either lump together your monthly living expenses or itemize them. The emergency fund calculator on Visa's Practical Money Skills website helps you figure out exactly how much cushion you'll need in case of a financial crunch. Practical Money Skills' emergency fund calculatorĪ general rule of thumb is to have three to six months' worth of living expenses saved in a rainy-day fund. The calculator generates a detailed report showing how much your savings will be worth at the end of the specified number of years. Whether the interest is compounded yearly, daily, monthly or quarterly. The rate of return - or interest rate - associated with your savings account.Īny additional contributions you will make and the frequency of those contributions. The number of years you expect to save money. Bankrate's compound interest calculator allows you to see how that money can grow. Instead of blowing through the small financial windfall from your graduation money, use it as a foundation for savings. Budgeting and saving Bankrate's compound interest calculator Here are Bankrate's top financial calculator picks for young adults. "What's most important is for a savvy consumer to say, 'Hey, if I jump onboard and I go to Insurance Company X and I do a life insurance needs calculation there, I'm going to probably get a higher estimated need for life insurance than if I hop onboard, let's say, ,'" Fox says, referring to a financial literacy site maintained by the federal government. Comparing calculatorsīe a bit skeptical when selecting a calculator, says Jonathan Fox, a professor and director of financial counseling at Iowa State University. For example, use calculators at this stage of your life to figure how to pay down credit card debt faster, but maybe not to determine how much to save for retirement. He advises millennials to choose calculators that can help with pressing financial goals. "It's the calculator tools that get into things that are more practical and near-term and finite that are most useful," says Michael Kitces, a partner and director of research at wealth management firm Pinnacle Advisory Group in Columbia, Maryland.

0 kommentar(er)

0 kommentar(er)